How Much Disability Coverage Should I Have?

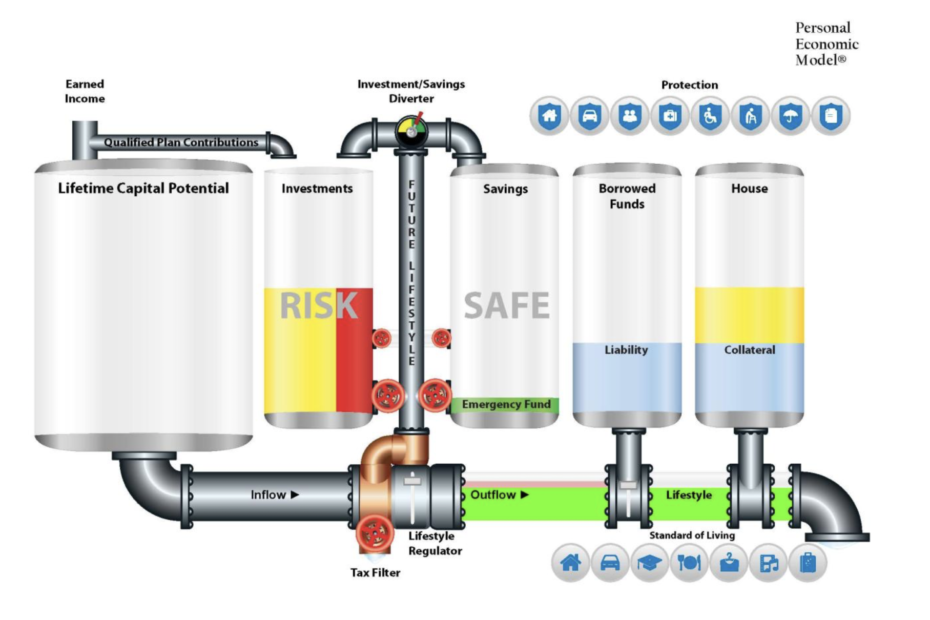

This is a question that you should have asked yourself and found an answer before now but realizing that this is an area that requires a decision that can easily be put off while you think about it we will give you a few things to think about. Of the decisions concerning disability coverage “How much coverage” is actually the easiest decision? Disability insurance is designed to protect your income in the event you are unable to work. Since the… Read More »How Much Disability Coverage Should I Have?